Search Results for 'Political economy'

87 results found.

1000s of Westmeath’s workers in line for Celtic Tiger tax return of nearly €840

Although Budget 2012 may not have provided much in the way of future reliefs for taxpayers the good news is that people still have an opportunity to claim the tax refund due to them for prvious years. This is according to leading tax specialists www.taxback.com who say that there is still a long list of tax reliefs available to people that could result in savings of hundreds of euro but many of these go unclaimed every year either due to a lack of awareness or unfortunately the apathetic nature of some people.

Kilkenny Enterprise Board offers Payroll Update course

Employers should be aware that there have been a number of significant changes to the calculation of employee deductions and the Universal Social Charge (USC) as a result of the 2011 Budget as follows:

P35 deadline time creeping up

The P35 deadline is creeping up on us fast, the date for returning your annual P35 return on time for the year ended December 31 2011 is February 15 2012.

Is tax due on my pension?

Last week, Revenue posted letters to 150,000 people about their tax compliance, including those who are claiming widow’s and widower’s pensions. Over the weekend, there was much comment and criticism in the media about the way Revenue has handled the situation. Accepting Revenue has taken a scattergun approach to the potential non-payment of income tax by pensioners, it is important that people understand how a tax liability might arise and that they have the information to hand to ensure they are compliant in 2012.

Increase in standard rate of VAT from next week

After much speculation, Minister for Finance, Michael Noonan, confirmed that the standard rate of Irish VAT is to increase from 21 per cent to 23 per cent with effect from midnight 31 December 2011. This VAT rate change is earlier than set out by the Government under the National Recovery Plan where it stated that the standard rate of VAT would only increase to 23 per cent in 2014.

Budget 2012 - exceptional times, exceptional Budget?

Budget 2012 is unique in that the proposed expenditure cuts were announced a day ahead of the tax changes and also many of its provisions were well flagged ahead of Budget Day. The financial adjustment was set at €3.8bn with €2.2bn coming from expenditure cuts and €1.6bn coming from increased taxation. Despite all the advance leaks and speculation the Minister managed to keep a number of the changes secret until the Budget Speech especially in the area of incentives to business and measures to kick start the property market.

Budget 2012 – What does it mean for your family/business?

One of the most anticipated Budgets of recent times was presented by Minister Noonan this week. Although, many of the measures announced had been expected, there were a few surprises.

Budget 2012 – A summary of the main provisions

Over recent weeks, there has been much speculation on the provisions to be announced in Budget 2012. The anticipation was heightened by the “State of the Nation” address by An Taoiseach Enda Kenny on Sunday night. In an unprecedented move, Minister Howlin and Minister Noonan shared the burden and spread their respective speeches over two days. Some of the main features introduced in the 2012 Budget are set out below:

A look at gifts and inheritance tax

The issue of inheritance and gift tax (CAT) is becoming more important to many people because of the reduction in the amount an individual can receive tax free. When an individual decides to transfer his/her assets to another person, either by gift or on their death, assets over a certain value will attract CAT. The current rate of tax is 25 per cent, there is speculation that it will increase in the upcoming budget. It is important that individuals plan the transfer of assets in a tax efficient manner, as many people may be forced to sell assets they have been gifted or left on an individual's death in an attempt to pay the CAT liability.

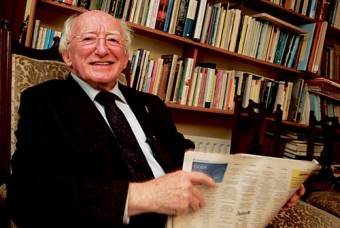

Will President Higgins speak for the people or the establishment?

Tomorrow will see former Galway Mayor and Galway West TD Michael D Higgins become the ninth president of Ireland. It will be a proud day for everyone from the city and county he has called home for the last 50 years.